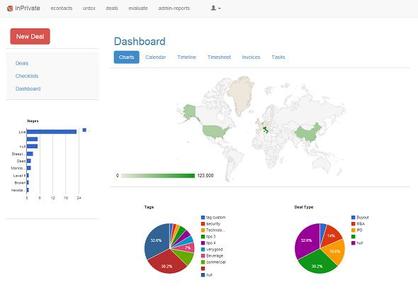

Measure your Performance as a General PartnerWe continue to enhance our solutions by developing value added benefits for our customers. We add new features upon your request, included in your subscription fee!Here what has been done for you this month on InPrivate:

Sign Up for a Demo Now or Create a Company Account, your first user is Free. You'll be able to add more users whenever you want according to our Pricing page. What is InPrivate? InPrivate is the Cloud Software dedicated to Private Equity Firms and Venture Capitals, but easily used by Business Advisors, Legal Firms and other companies for keeping track of their Deal Flow and their Fund Raising processes. Custom modules are also available for Investor Accounts Reporting, HR Assessment, and more. See www.inprivate.info for details or read our features flyer. What about Services? We'll give you all the support and the advice you need for starting up with InPrivate and we encourage you to ask for new features. InPrivate will help you optimize for efficiency, save time, reduce stress and increase customer satisfaction. Do you know any reason to wait more? Sign Up for Free today, or contact us

0 Comments

Some major features have been added last month following our customer requests. We are excited to describe the new benefits that have been put in place recently:

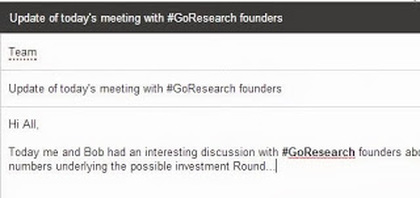

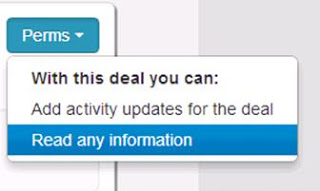

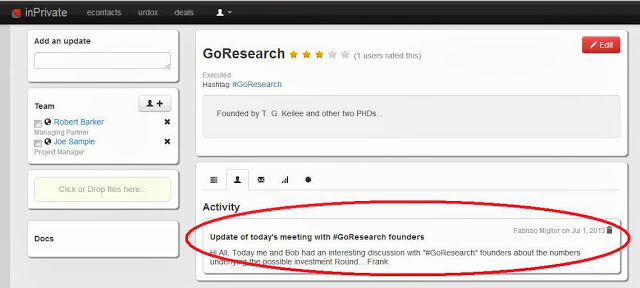

What is InPrivate? InPrivate is the Cloud Software dedicated to Private Equity Firms and Venture Capitals, but easily used by Business Advisors, Legal Firms and other companies for keeping track of their Deal Flow and their Fund Raising processes. Custom modules are also available for Investor Accounts Reporting, HR Assessment, and more. See www.inprivate.info for details or read our features flyer. What about Services? We'll give you all the support and the advice you need for starting up with InPrivate and we encourage you to ask for new features. InPrivate will help you optimize for efficiency, save time, reduce stress and increase customer satisfaction. Do you know any reason to wait more? Sign Up for Free today.  "A hashtag is a word or a phrase prefixed with the symbol # ... Hashtags provide a means of grouping such messages, since one can search for the hashtag and get the set of messages that contain it." (from Wikipedia) Hashtags are extensively used on social networks, but they could be helpful for your business, too. Imagine to keep in copy your Deal Flow Management System while writing an e-mail related to to a specific activity you've done you just want to send to your team: by including a specific hashtag as your deal's identifyer, your system will parse it and will add it to the activity log of the deal. inPrivate Deal Flow Updates your deals by parsing your e-mails and seeking hashtags inPrivate has now this hastag parsing feature for inbound e-mails: try it by subscribing for a free Trial here.  We are excited to announce a new major release of inPrivate Saas with unlimited support for permissions and roles on the users of your organization; you will share your deals only with specific users assigning different privileges to let your team members view or edit each information. Your confidential information will be shared only betweeen limited groups of users. The new Dealflow also supports:

If your company is an Advisor in the Private Equity Business, is a Venture Capital or if you are in any other industry, the use of checklists for managing your projects is very common. So, there's nothing new with the use of the checklists itself. But depending on how you use your checklists and on how much you are accurate in your approach, your results will be different and the time you could save could vary a lot. You have a huge experience and a long track record of Deals in the Private Equity Business, you are a M&A Advisor or you manage a Venture Capital Fund, so you should use your knowledge (and a bit of your time) to identify the common tasks for each category of the Deals that you know. You probably consider each Deal unique, with a lot of unattended events, and you know that the key variables to succeed are 'soft', due to the ability on creating relationships, on understanding other's intentions, negotiation, and so on. So: managing a Deal Flow is not like building a car in 1930. True. Anyway, you'll have a lot of benefits by seeking a formal (and flexible) model; more than a schema is possible, but let's now analyze the checklist approach: - Choose the set of stages your deals could have (i.e.: Screening, Live, Success, Broken, etc) - Identify the macro categories of your deals (i.e.: M&A, IPO, etc...) - For each category, create a checklist with a list of Tasks. This is the key and the most difficult task; try to focus on the type of tasks you could have in the category and write down some instructions specifying the input and output for each task, such as writing/signing a document, meeting with contacts and so on. Always create an 'End' task to mark the checklist as finished. - Identify wich tasks require to manage a list of contacts to be completed. In a task focused on finding customers or investors, you should iterate on a list of prospect contacts and you should do some action for each one. Then you should instantiate your checklist model for your real world. How? And how to keep it flexible/adaptive? Try it using a spreadsheet, but keep in mind that you can't manage more than a few complex deals in Excel without confusion; some hints:

Let me have your comments. On inPrivate Software we recently introduced a flexible way to manage checklists and tasks inside the deals, Sign Up for free here, learn more about inPrivate Software or ask for a Demo here. |

CategoriesArchives |

Our Products & Services |

Company |

Support |

Copyright © 2014 InPrivate.info | +1 (650) 691-8579 | +39 333 3405514 | info@inprivate.info | V.A.T. 04035460965

RSS Feed

RSS Feed